november child tax credit payment date

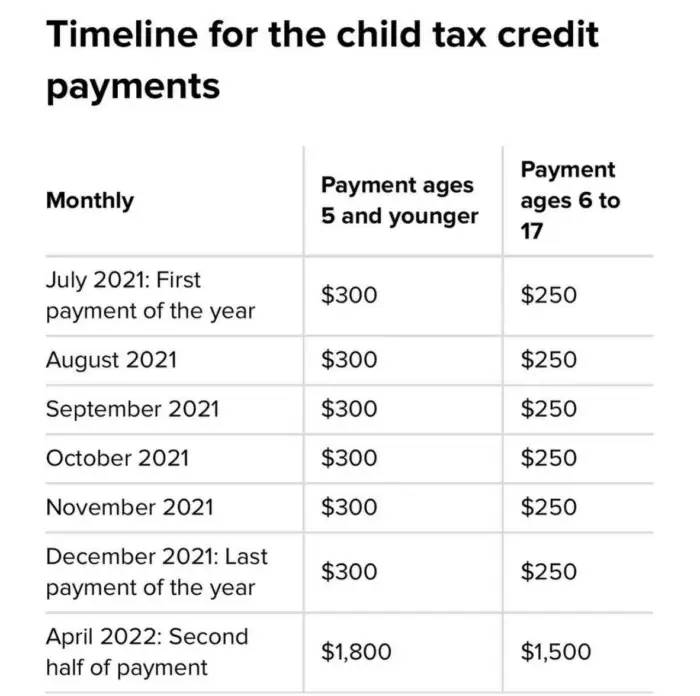

This years expanded Child Tax Credit allotted 3600 per child age five and under in all eligible families and 3000 per child ages six to 17. The IRS sent six monthly child tax credit payments in 2021.

Discover Child Tax Credit Eligible S Popular Videos Tiktok

They should encourage such officials to act before the November 15 final date and claim the funds this year which is significant and can reach out to thousands of suffering.

. To get the first cost of living payment of 326 you must have been entitled or later found to be entitled for any day in the period 26 april 2022 to 25 may 2022 to. The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17Eligible families who did not opt-out of the monthly payments will receive 300 monthly. Six payments of the Child Tax Credit were and.

Mark These Dates on Your Calendar Now. 15 opt out by Aug. Oliver Povey Olabolob Update.

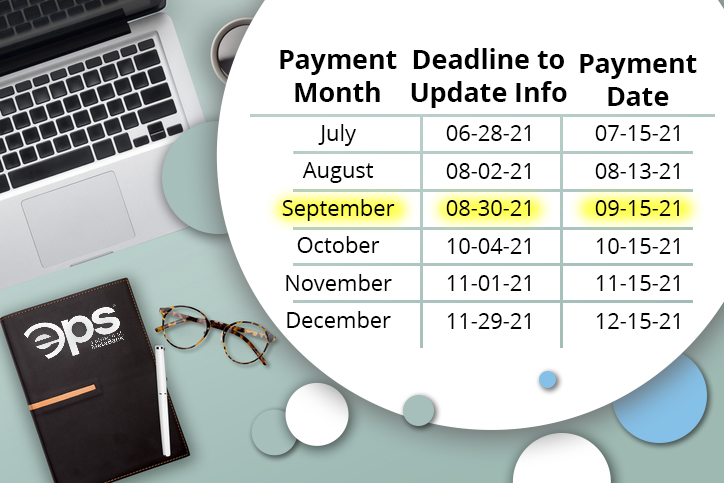

If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. Those who requested paper checks should have them by October 31. Wait 10 working days from the payment date to contact us.

Residents filing their 2021 return in the period from August 1 to December 31 should expect to receive. CBS Baltimore -- The fifth Child Tax Credit payment from the Internal Revenue Service IRS will be sent this coming Monday. 4 2022 CNW Telbec - The first of the Government of Canadas new financial support measures will take effect this Friday November 4 2022 with the.

The IRS issued three Economic Impact Payments during the coronavirus pandemic for people who were eligible. Alberta child and family benefit ACFB All payment dates. CBS Baltimore -- The fifth.

1200 in April 2020. 28 December - England and Scotland only. Child Tax Credit Dates Here S The Entire 2021 Schedule Money 2 days agoAccording to a recent.

The payment for the. IR-2021-222 November 12 2021 The Internal Revenue Service and the Treasury Department announced today that millions of American families will soon receive their. The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17Eligible families who did not opt-out of the monthly payments will receive 300 monthly.

The Internal Revenue Service will soon start sending out the advanced payments of the child tax credit for November. The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17Eligible families who did not opt-out of the monthly payments will receive 300 monthly. The payment for the Empire State child credit is anywhere from 25 to 100 of the amount of the credit you received for 2021.

600 in December 2020January 2021. For each kid between the ages of 6 and 17 up to 1500 will come as 250 monthly payments six times this year. The fifth installment of the Child Tax Credit is just around the corner and it is falling on the same day as most of the other payments.

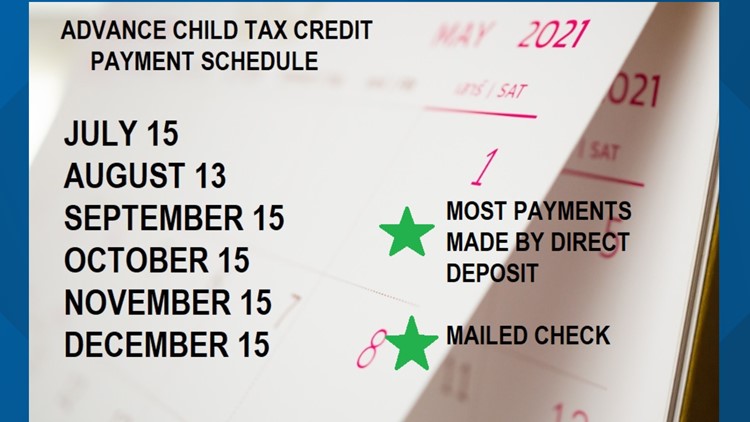

The percentage depends on your income. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. 3 January - England and Northern Ireland only.

November 12 2021 1226 PM CBS New York. The maximum monthly payment for a family that received its first payment in. American families who qualify for the enhanced Child Tax Credit still have a couple more weeks to sign up for it.

The taxpayers that have eligible children under the age of 6 receive 300. 13 opt out by Aug. OTTAWA ON Nov.

If your payment is. The payments were split up into six. The IRS bases your childs eligibility on their age on Dec.

What Is The Child Tax Credit Payment Date In November 2021 As Usa

How To Opt Out Of Advanced Child Tax Credit Payments And Why Some Accountants Advise It Wbma

The Irs Will Be Sending Parents Monthly Payments In One Week Wfmynews2 Com

Child Tax Credit How To Opt Out Of Monthly Payments For One Payout

Child Tax Credit Payments The Pros And Cons Of A New Republican Plan

Exact Date Families Have To Claim Up To 3 600 Per Child The Simple Tool To Take Action The Us Sun

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Eps Powered By Pathward The Child Tax Credit Payments Pros And Cons To Think About

The Monthly Child Tax Credit Payments Are Done Here S What Will Replace It Fortune

When Is The Next Child Tax Credit Check Coming Wtsp Com

The Monthly Child Tax Credit Payments For Parents Start Tomorrow Here S How To Check On Your Payment

Child Tax Credit 2022 Huge Direct Payments Up To 750 Already Going Out To Families See Full Schedule The Us Sun

These Are All The Important Child Tax Credit Dates You Need To Know

Abc7 Tens Of Millions Of Families Have Been Sent The First Payment Of The Expanded Child Tax Credit The Irs And The Treasury Department Said If You Re One Of Those Families

After Child Tax Credit Payments Begin Many More Families Have Enough To Eat Center On Budget And Policy Priorities

Tax Tip Update Your Address By August 30 For September Advance Child Tax Credit Payments

Parents Still Have Time To Claim Child Tax Credit Of Up To 3 600

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet